The Friction Economy: How User Experience Failures Create Systematic B2B SaaS Disruption

July 13th, 2025The B2B SaaS industry has entered a new era of competitive dynamics I call the “Friction Economy.” My analysis of market data from 2018-2025 reveals that 75% of B2B SaaS companies maintain high retention despite declining user satisfaction, creating conditions for explosive disruption when competitors offer friction-free alternatives.

This white paper also introduces the Sentiment-Inertia Index (Sii), a predictive metric that quantifies disruption risk by measuring the gap between user satisfaction and churn rates. Companies with Sii scores above 35 face elevated risk of customer defection through bottom-up revolts I’ve termed Frustration Coalitions.

Key findings:

- PLG adoption reached 61% of Cloud 100 companies, proving that PLG is no longer a niche strategy

- AI reduced development costs by 30-50%, enabling smaller teams to compete with incumbents

- Roughly 75% of employees estimated to use shadow IT to circumvent approved tools by 2027

- Companies maintaining 95-99% retention with < 40 NPS are most vulnerable to disruption

Companies must urgently address underlying friction points, proactively embracing user-centric strategies to transform vulnerabilities into competitive strengths. Those that fail to adapt risk rapid displacement by agile competitors positioned to capitalize on widespread user frustration.

Understanding the Friction Economy Through Established Frameworks

The Friction Econony exists within a broader set of established strategic principles, notably Jobs to be Done (JTBD), Frustration Coalitions, and Blue Ocean Strategy. Together, these frameworks provide an integrated view of market disruption driven by user frustration, collective action, and competitive repositioning.

Jobs to be Done (JTBD): The Origin of User Frustration

Jobs to be Done theory posits that users “hire” products to perform specific tasks or “jobs.” The effectiveness of a product in performing these jobs determines its market fit. User frustration arises when a product initially hired to accomplish a particular job fails to adapt as user requirements evolve.

- Original Job: A small startup may hire a collaboration tool to enable quick, informal communication.

- Evolved Job: As the company scales, user needs evolve towards structured, secure, administratively simple collaboration integrated into existing systems.

This misalignment between evolving user needs and the product’s original job is the catalyst for widespread user frustration, creating the conditions necessary for collective action (“Frustration Coalitions”).

Frustration Coalitions: The Collective Action of User Frustration

Frustration Coalitions are a social mechanism where individual user dissatisfaction organizes into collective action that drives competitive displacement. Where JTBD explains why user frustration accumulates when products fail to adapt to evolving customer jobs, Frustration Coalitions describe how this frustration translates into collective user action. They’re covered in more detail below.

Blue Ocean Strategy: Competitive Exploitation of User Frustration

Blue Ocean Strategy argues that sustainable competitive advantage is achieved by redefining market terms—shifting competition away from traditional metrics (feature completeness) toward dimensions that directly address unmet user needs (feature correctness).

Competitors exploit widespread frustration by reframing the value proposition, such as:

- Providing solutions at zero incremental cost.

- Minimizing administrative complexity.

- Offering seamless ecosystem integration.

- Excelling specifically at critical user needs left unmet by incumbents.

This strategic reframing shifts the user’s purchasing decision, transforming frustrated yet locked-in users into willing adopters.

Integrated Model of Market Disruption

Collectively, these frameworks provide a clear model for systematic disruption:

- Jobs to be Done: explains the root cause of user frustration.

- Frustration Coalitions: describe how this frustration translates into collective user action.

- Blue Ocean Strategy: outlines the competitive approach to capitalizing on this vulnerability.

This combined perspective reveals market disruptions as predictable outcomes rooted in user experience.

Market Analysis: The End of the Lock-in Economy

The rise of the Friction Economy signifies the decline of traditional user lock-in strategies, exposing entrenched incumbents to escalating risk from emerging competitors. Market analysis demonstrates how historically reliable retention metrics now mask widespread user dissatisfaction, leaving organizations increasingly susceptible to rapid disruption.

Why NPS matters MORE than ever (while 75% abandon it)

Analysis of 2,000+ B2B SaaS companies (ProfitWell, 2017-2018) reveals a critical disconnect: for 75% of companies, Net Promoter Score (NPS) had no significant correlation with retention. Users remained locked in by switching costs despite dissatisfaction, illustrated by an academic correlation coefficient of only 0.170 between NPS and retention. This lack of alignment between satisfaction and retention represents widespread vulnerability to disruption.

Accelerating Conditions for Disruption

Three market shifts have compressed the timeline from user frustration to competitive displacement:

-

Product-Led Growth emerged (2015-2020): The go-to-market response to trapped frustration. Smart companies learned that the best way to fight high switching costs was to start removing them. What took 18-month sales cycles and executive buy-in starting taking 6-12 months and employee consensus. How do most new tools get adopted in your own organization today?

-

AI demolished building barriers (2022+): After ChatGPT, everything accelerated. Cursor’s 60-person team competes directly with Microsoft with development time compressed from years to months. Lovable taking prototyping and demoing from months or weeks to just days. One person vibe coding a 44m deal sealing app. The speed will only continue to accelerate as these benefits find PMF in other verticals. We’ve gone from the development, design, and prototyping of entire products taking days or weeks, not months or years.

-

Remote work normalized shadow IT: When everyone works from home, employee needs changed and in response corporate software controls evaporated. That strict IT policy? It’s fiction. Users composed their own stacks from tools that allowed them do they’re job without overwhelming frustration. It’s not that they want to use new tools, change is often uncomfortable, but once the discomfort of the existing solution outweighs the discomfort of adopting a new one, the switch becomes inevitable.

The result of all this? NPS finally works as intended. It predicts churn because users can actually cause entire companies to leave. Gartner predicts 75% of organizations will abandon NPS by 2025, this year! They’re throwing away their smoke detector while the house fills with smoke.

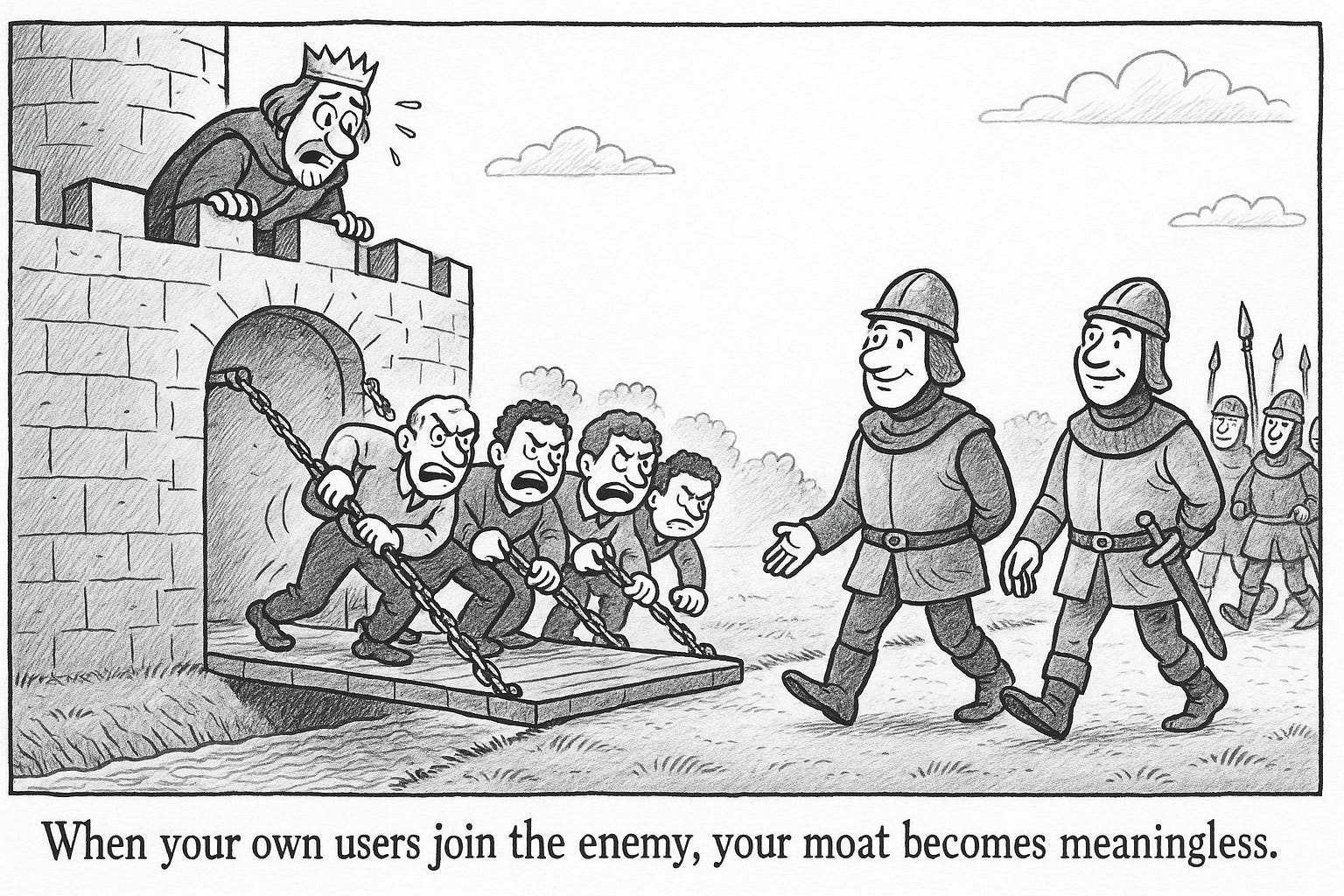

Frustration Coalitions

A Frustration Coalition is an informal alliance of end-users within an organization who unite around shared dissatisfaction with an incumbent tool, ultimately driving organizational switching decisions. This concept is grounded in modern coalition theory dynamics, specifically adapted to software adoption contexts, where informal networks exert significant influence on technology choices.

The 6-Stage Formation Process

Understanding how coalitions form helps predict when customer churn risk is building beneath superficially stable metrics:

-

Individual friction: Users encounter persistent pain points disrupting daily workflows, creating ongoing personal dissatisfaction.

-

Collective recognition: Multiple users begin to recognize frustrations as systemic and widespread rather than isolated personal experiences.

-

Alternative research: Proactive individuals start exploring competitor solutions, sharing insights and comparisons within their networks.

-

Coalition formation: An informal group solidifies around a specific competitor solution that directly addresses their frustrations.

-

Internal advocacy: The coalition presents a cohesive, well-documented business case to organizational decision-makers, highlighting benefits of switching.

-

Switching decision: Organizational leadership responds by choosing the path of least internal resistance—aligning with user preferences to resolve collective dissatisfaction.

Each stage progressively builds internal momentum, making it increasingly difficult to halt the process once critical mass within the coalition is achieved. Understanding these dynamics provides essential insights into customer retention vulnerabilities beyond traditional satisfaction metrics.

The Sentiment-Inertia Index: Quantifying Disruption Risk

To accurately predict and manage disruption risk within the Friction Economy, organizations need clear metrics that expose underlying user dissatisfaction hidden by traditional retention measures. The Sentiment-Inertia Index (Sii) provides an effective tool to quantify the gap between customer satisfaction and churn, enabling strategic action before frustration coalitions trigger market displacement.

Formula and Examples

The Sentiment-Inertia Index measures trapped user frustration:

Where:

- NPS = Net Promoter Score (-100 to 100)

- Churn Rate = Monthly customer churn percentage

Risk Scale

This table outlines risk levels associated with the Sii score:

| Sii Score | Risk Level | Interpretation |

|---|---|---|

| < 15 | Low Risk | High customer satisfaction is reinforced by a strong moat (low churn). The user base is stable and happy. |

| 15-45 | Guarded | Satisfaction may be declining or mediocre, but the moat is largely intact. An early warning to investigate sentiment. |

| 45-60 | Elevated | A significant level of dissatisfaction is being contained by customer lock-in. Prime conditions for a mass exodus. |

| > 60 | Critical | An extreme amount of user frustration is trapped. The user base is highly vulnerable to a competitor’s arrival. |

Real-World Calibration of Sii Scores

Looking at some notable enterprise software companies within the B2B SaaS industry, you can see how Sii scores translate to competitive risk in practice:

| Company Type | Example | NPS | Monthly Churn | Sii Score | Risk Level |

|---|---|---|---|---|---|

| Extreme Lock-in | SAP/Oracle | ~15 | ~0.5% | 170 | Critical |

| Disruption Target | Jira/Confluence | ~35 | ~1% | 65 | Critical |

| Acquisition Panic | Adobe | ~40 | ~1% | 60 | Elevated |

| High-growth PLG | Linear/Notion | ~60+ | ~3% | 13 | Low Risk |

| Enterprise PLG | Glean | ~70+ | ~0.5% | < 5 | Low Risk |

Industry Benchmarks

This analysis synthesizes public market data, academic research, and documented case studies from 2018-2025. All metrics represent publicly verifiable industry aggregates unless otherwise specified.

Current B2B SaaS averages:

- NPS: 40 (~35-45)

- Monthly churn: 1% (~0.5 - 1.3)

This produces a typical Sii score of 60—right at the edge of the critical risk zone.

Case Study Analysis: Patterns of Disruption

Examining real-world examples of Frustration Coalitions clarifies the conditions under which entrenched incumbents become vulnerable to targeted disruption. The following case studies illustrate how unresolved user frustrations translate into decisive competitive threats across diverse B2B SaaS contexts.

Atlassian (Jira/Confluence) vs Linear/Notion

Atlassian’s tools demonstrate classic high-retention/low-satisfaction patterns:

- Developer complaints about Jira’s complexity created coalition conditions

- Notion’s Community-Led Growth strategy weaponized Confluence frustration coalition

- Templates enabled instant workflow implementation and value proof

- Bottom-up adoption through shared solutions accelerated switching

Atlassian’s vulnerability despite high retention underscores how unresolved complexity and friction can serve as fertile ground for competitors who strategically leverage community-driven adoption. This demonstrates the necessity of continually aligning product design with evolving user workflows to mitigate coalition risks.

Adobe vs Figma

Adobe’s attempted $20B acquisition of Figma validated that reducing collaboration friction creates more value than feature advantages. Figma’s success came from:

- Eliminating file versioning friction

- Real-time collaboration removing handoff pain

- Designer coalitions advocating internally

- Browser-based access bypassing IT restrictions

Adobe’s costly attempt to acquire Figma highlights how rapidly and effectively competitors can exploit specific friction points, such as collaboration and file management pain. The case reinforces that proactive friction reduction around users’ core jobs provides a crucial competitive advantage in preventing coalition-driven market disruption.

Microsoft/GitHub (VS Code/Copilot) vs Cursor

Cursor demonstrates how AI-native startups can challenge tech giants by eliminating friction:

- VS Code users frustrated with Copilot’s limited context awareness and integration friction

- Cursor’s 60-person team competed directly with Microsoft by building AI-first

- Developer coalitions formed around superior AI pair programming experience

- Zero switching costs (familiar VS Code interface and configuration interoperability) accelerated adoption

- Shadow IT adoption through individual developer licenses bypassed procurement

Microsoft’s dominance in developer tools faces disruption from a startup that understood developers wanted AI deeply integrated, not bolted on. This validates how AI enables small teams to compete with unlimited resources by focusing on friction elimination.

The Platform Defense: Converting Threats to Assets

To mitigate the risks posed by Frustration Coalitions, companies must strategically address user friction by clearly distinguishing between core and customer-specific Jobs to be Done. By doing so, organizations can proactively redirect user frustration into constructive channels, enhancing customer loyalty and promoting advocacy.

The Core vs Customer Gap Theory

Successful platform strategies separate core JTBD gaps from optimized/extended JTBD gaps:

- Core Product Gaps

- Non-negotiable JTBD workflows

- Performance and latency issues

- Critical feature limitations

- Users are unable to complete core workflows without significant friction

- Customer Product Gaps

- Industry-specific workflows built on core JTBD

- Company-unique processes built on core JTBD

- Custom automation and extension needs to optimize core JTBD

- Users are unable to optimize or extend core workflows without significant friction

Using a clean delineation between the core job-to-be-done and optimization/extension use cases helps: 1) see where resources are being invested a bit more clearly in relation to user friction on mission critical workflows, 2) helps prevent the product surface from becoming something too complex at the individual level.

Instead of users saying, “This tool doesn’t work for our use case,” a healthy platform empowers them to say, “Let’s build what we need.” It transforms the most technical and often most critical users from potential coalition leaders into your biggest champions. They go from being frustrated users to empowered builders.

Platform Advantage Metrics

Platform strategies show measurable advantages:

- 15-20% higher retention than point solutions

- 125% net dollar retention through expansion

- 7x average expansion potential

These metrics reinforce that a platform defense strategy directly addresses the core vulnerabilities exposed in the Friction Economy. By proactively resolving core friction points and empowering users to extend workflows through customization, companies neutralize the conditions required for Frustration Coalitions to form, effectively turning potential threats into sustainable competitive advantages.

Market Implications and Predictions

Understanding the dynamics of the Friction Economy reveals critical implications for the near-future competitive landscape of B2B SaaS.

The Coming Disruption Wave

Several clear trends indicate a significant acceleration of disruption driven by friction reduction and rapidly evolving user expectations. Based on current market dynamics, I predict:

- Increased disruption velocity: AI enabling development in 1-3 months means incumbents face constant competitive pressure.

- Category collapse: Traditional software categories will blur as PLG adoption by 61% of growth companies enables rapid feature expansion and AI redefines the job-to-be-done and how fast entrants can challenge incumbents.

- Valuation recalibration: Companies with high Sii scores (trapped users) will face valuation pressure as switching costs approach zero.

- Platform consolidation: Only companies enabling user customization while consistently improving core job-to-be-done workflows will maintain sustainable competitive advantages.

These predictions underline the urgency for companies to proactively realign their strategic priorities and adapt rapidly to emerging shifts driven by user friction, technological innovation, and evolving market expectations.

Strategic Recommendations

In the Friction Economy, competitive advantage hinges on recognizing and addressing emerging user frustrations early. The following recommendations provide clear guidance tailored to incumbent organizations and agile disruptors, enabling each to strategically position themselves to either defend against or capitalize on friction-driven market shifts.

For Incumbents

Incumbent companies face growing disruption threats driven by shifting user expectations and rapidly advancing technologies. To proactively mitigate these risks, incumbents should focus on the following strategies:

- Calculate and monitor Sii scores quarterly.

- Identify top 3 core JTBD workflow friction points.

- Implement platform capabilities enabling user/customer solutions.

- Track shadow IT as an early warning system.

- Reduce switching costs while increasing switching benefits.

By continuously aligning product capabilities with evolving user demands and actively tracking friction indicators, incumbents can effectively defend against disruption and maintain competitive advantage.

For Disruptors

Disruptors have a significant opportunity to capitalize on widespread user frustration within incumbent markets. To swiftly and effectively exploit these vulnerabilities, disruptors should concentrate on the following tactics:

- Target markets with Sii scores > 60.

- Map specific friction points through public review analysis.

- Enable bottom-up trials removing procurement friction.

- Focus on workflow perfection over feature completeness.

- Leverage AI to maintain innovation velocity advantage.

By precisely addressing unmet user needs and streamlining user adoption, disruptors can rapidly build coalitions of support and accelerate market penetration.

Incumbents may find greater strategic advantage by focusing less on rushing AI features to market, and instead prioritizing how AI is reshaping the core jobs-to-be-done based on evolving user needs. Remaining resources and effort can then be directed toward building internal innovation platforms designed to proactively identify emerging friction coalitions and quickly address deviations from product-market fit.

Conclusion

The Friction Economy represents a major shift in B2B SaaS competition. The 75% of companies showing no NPS-retention correlation built businesses on trapped users rather than satisfied customers. As PLG and AI eliminate traditional barriers, these companies face systematic disruption from competitors who understand that reducing friction creates more value than adding features.

Companies must choose: eliminate friction proactively or watch competitors weaponize user frustration into market share. The Sentiment-Inertia Index provides an early warning system, but only organizations willing to completely reimagine their user experience will survive the transition from the Lock-in Economy to the Friction Economy.